In this episode we look at the the question of what money is and how it is created.

The answers may surprise you!

Click here to view it in your browser or 'Right Click' and choose 'Save As' to download it without iTunes (170Mb).

(Things in bold and brackets are my additions for the web site)

Hello and welcome to Money Myths Episode 1 - What is Money?

My name is Brian Leslie and I'm the editor of Sustainable Economics magazine.

Before we get started, I have a couple of things to mention.

First: This is part one of the series but, if you've not yet seen it, I would suggest that you look at the web site (www.moneymyths.org.uk) where you will find information about the series and a list of episodes. You will also find a "Subscribe via iTunes" link to subscribe and get all the episodes as they become available.

I’ve also written a short booklet called “Where’s the Money to Come From??” and you’ll find a "Donations" button where you can show your appreciation by making a donation to help cover the show's expenses.

Second: If you haven't seen Part 0 - Series Introduction, I would suggest that you watch that first to get a rough idea of what the show is about as we aim to build the show on the basis that viewers have seen the series in order.

Although I am referring to the British Banking System for this series the system in most countries is the same and has a similar history. I leave it up to you to substitute your own Central Bank, Government, Ruler, and so on.

OK, so on with part One: What is money?

In brief, it’s anything generally accepted within a group as a means of exchange. Some things that have been used as money have value of their own such as gold or silver. This is known as the ‘intrinsic’ value. Other things used as money such as paper or shells have little or no value in themselves. Either way they are accepted as tokens to be used for the purchase of goods or services.

Another form of money in Britain for many centuries was the use of ‘tally sticks’ as receipts for large-value taxes. These were sticks of hazel, notched in a way to indicate the value. They were then split along their length, and the tax-man kept one half, while the other formed the receipt, which then could be used as money.

This system only finally ended in the 19th century when a fire being used to dispose of them got out of hand and burnt down the Houses of Parliament!

So how is money created? Most people think that money is just the notes and coins in their pockets and that it is created by the Government and spent into circulation. Well, some of it is.

In the 1940’s about 40% of the money in circulation was in the form of Government issued notes and coins. It is now only about 3%.

Why is this? In the Middle Ages, Merchants would put their spare gold into the safekeeping of the Goldsmiths, who had secure vaults. They were given paper receipts for the gold. The Merchants soon realised that instead of having to go to the Goldsmiths to take out some gold to use for payments they could pass on the receipts instead. This was how our paper money started.

The Goldsmiths also ‘loaned’ gold from their vaults. They charged interest on the loans. However, they could only lend actual gold from the supply they had in their vaults.

The greedy Goldsmiths realised that they could make loans in the form of the paper receipts that were being used ‘as’ gold. They then realised that most of the gold in their vaults was never taken out by the depositors.

So they started issuing receipts for much more gold than they actually had. As long as no one found out then there wouldn't’t be a problem. This increased the money supply, and as long as they were not too greedy, they wouldn't be found out.

So began the modern system called ‘fractional reserve’ banking.

The interest they charged on the loans eventually proved more profitable for some, than their work as Goldsmiths, and they had become the first Modern Bankers.

Gradually, the new banks took over the task of money-creation from the rulers (Kings, Governments, etc.), by issuing their own banknotes. This practice went on until it was outlawed in Britain in the 19th century.

The Bank of England, which was still a private bank, had special privileges granted to it, along with special responsibilities, and was the only bank then allowed to issue banknotes.

As the other banks could no longer print their own banknotes, and therefore couldn't’t make profits from loaning them out, so they started encouraging the use of cheques, and, more recently, credit or debit cards and electronic transfers.

This allowed them to continue to create money by making loans. As already noted, by the 1940s, after the Bank of England had at last been nationalised, about 40% of the money supply was still in the form of Bank of England issued notes and coins. This has now dwindled to only about 3%.

(So How do banks create money?)

When a bank makes a loan, it does two things: First it credits the borrower’s account with the money and records it as a ‘liability’ of the Bank. In other words, the Bank has entered into its system the ability for the borrower to go and spend the value of the loan at some future time.

Then it records the loan as an ‘asset’, owed by the borrower, to the Bank, again in the future. Thereby ‘balancing’ its books.

In addition to the amount of the loan, the borrower has to pay interest.

The money loaned does not come from any depositor’s account.

What it’s done is to create the money it lent out of nothing – or rather, out of account entries.

The bank has to keep available enough ‘reserve’ to meet demands for payments. This limits the extent it can expand the money supply by making loans.

For much of the last century there was a statutory ‘fractional reserve’ required of around 10%. That means that banks had to keep reserves made up of notes and coins and deposits in their own accounts with the Bank of England.The reserves had to equal at least 10% of the amount they had out on loan.

In the 1970s this legal limit was lifted, so reserves have dwindled to much less, and the money supply has mushroomed!

Let’s look at an example.

With a reserve requirement of 10%, bank#1 starts with assets of £1,000 in its account. It now lends £900 to someone else, so it has £100 reserves and an ‘asset’ of the £900 owed to it.

With the remaining £100 in its reserves and the £900 loan it still has £1000 of assets.

The borrower then spends the money and it is deposited into another bank, Bank 2.

Bank 2 can now lend out £810 of the £900 to someone else, and keep the remaining £90 to add to its reserves (the 10% reserve requirement).

Again, the borrower spends it and the money goes to Bank 3.

This bank now has an asset of £810 and can lend £729 to someone else; and so on.

| Bank 1 | £1000 | £100 | £900 |

|---|---|---|---|

| Bank 2 | £900 | £90 | £810 |

| Bank 3 | £810 | £81 | £729 |

| Bank 4 | £729 | £72.90 | £656.10 |

| Etc.... Totals | ~£10,000 | ~£1000 | ~£9000 |

This can continue with ever-decreasing amounts, until eventually the original £1000 has allowed the banks between them to create another £9000. And the banks are charging interest on all of this new money.

This has expanded the money supply by £9000.

So, the bank creates money. The bank ‘lends’ the money to society. The bank charges interest, just like the Goldsmiths did. The money that the bank created is eventually re-paid to the bank and is cancelled out of existence but there still remains a debt to be paid in the form of interest.

Let’s think about this for a moment.

(Another Example)

Let’s simplify the numbers and give an example of the underlying problem of the current system.

We have 11 people in a closed room. 10 of them have nothing and the 11th has a bowl of beads. We’ll call the 11th person The Bank.

The Bank now lends each person 10 beads for 1 hour and charges 10% interest on the loan.

The people in the room are free to sell whatever they have to the other people in the room in exchange for beads.

An hour passes.

Some people have now got the 11 beads they need to repay the Bank. This means that others don’t.

It is obvious that there are not enough beads in the room for everyone to repay The Bank.

So, what can be done?

Well, some could ‘declare themselves bankrupt’ and hand over their assets to The Bank or, some people could take out further loans from The Bank.

If The Bank allows these people to take out other loans that would ‘boost the economy’ and allow all of the people to repay their debts from the original round of lending.

Of course, anyone who borrowed is now in further trouble. They must repay the new loan plus the interest.

As you can see, there are never enough beads in the room to repay The Bank.

This growth of the money supply, along with the even greater growth of debt is the fundamental cause of the current ‘credit crunch’, because of the interest imposed on all this 'bank created' money.

Since the deregulation of the banks in the 1970s, the banks have been able to expand their money-creation greatly. They now have only tiny reserves, but huge profit from the interest they make on all the loans.

This enriches them and their shareholders, at the expense of society.

The banking system has always been precarious, and is now far more so. With such small reserves to call on when customers withdraw their money it only takes a few ‘bad debts’ to be written off, or a few people to lose trust in the bank and to withdraw their money, for the bank to run into problems. Once news gets out that a bank is in trouble, others start withdrawing their money and the bank becomes bankrupt.

With the ever-growing levels of debt due to the way the banks create our money by making loans, and the growing amount of interest to be paid on those loans, any slowing of ‘economic growth’ can threaten the whole banking system with collapse as the debts become un-repayable – which is why the authorities are now so desperate.

With ‘globalisation and deregulation’ since the 1970s, the banks have been heavily involved with international trade, and so the ‘credit crunch’ is affecting the whole world. I will be dealing with this aspect in a later episode.

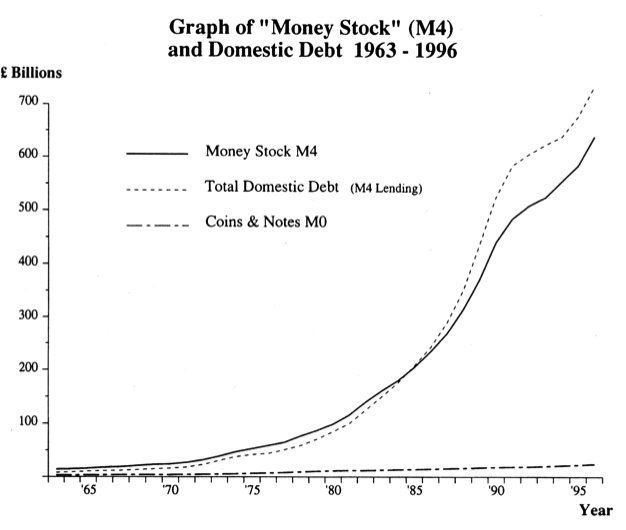

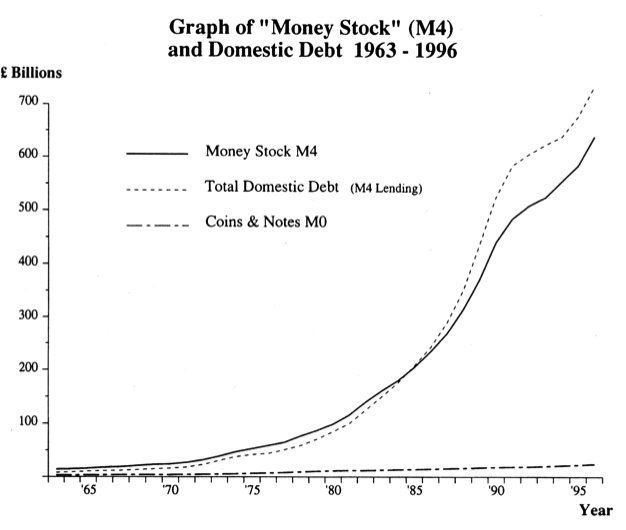

One last thing I would like to show you is the 'Growth' in the level of debt in the UK. The shape of the graph (taken from Michael Rowbotham book, The grip of Death) is almost identical for the US and many other countries. Although there has, for centuries, been the problem of 'not enough money' to repay all the debts and the interest on them, the problem has been getting rapidly worse since the 1970s. This graph only shows the period from 1963 to '96. Since 1996 the problem has got even worse.

There are also many other social, economic and environmental problems arising from this system, which I will also talk about in later episodes.

In the next episode I will be looking at possible solutions to the current situation.